CS1 Consumption/saving model with borrowing constraint

This is an implementation of the model in Deaton (1991).

Contents

Model's structure

Response variable Consumption ( ).

).

State variable Cash on hand ( ).

).

Shock Labor income ( ).

).

Parameters Interest rate ( ), Rate of time preference (

), Rate of time preference ( ), and Elasticity of intertemporal substitution (

), and Elasticity of intertemporal substitution ( ).

).

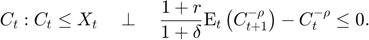

Equilibrium equation

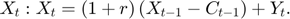

Transition equation

Writing the model

The model is defined in a Yaml file: cs1.yaml.

Create the model object

Mean and standard deviation of the shocks

Mu = 100; sigma = 10;

You generate the MATLAB model file and pack the model object with the following command

model = recsmodel('cs1.yaml',... struct('Mu',Mu,'Sigma',sigma^2,'order',5));

Deterministic steady state (equal to first guess)

State variables:

X

___

100

Response variables:

C

___

100

Expectations variables:

E

______

0.0001

This command creates a MATLAB file, cs1model.m, containing the definition the model and all its Jacobians from the human readable file cs1.yaml.

Define approximation space

[interp,s] = recsinterpinit(20,model.sss/2,model.sss*2);

First-guess: Consumption equal to cash on hand

x = s;

To force the solver to compute the approximation of the expectations function, it is necessary to add at least an empty value for interp.ch

interp.ch = [];

Solve for rational expectations

[interp,x] = recsSolveREE(interp,model,s,x);

Successive approximation

Major Minor Lipschitz Residual

0 0 1.08E+02 (Input point)

1 1 0.6916 3.35E+01

2 1 0.5517 1.50E+01

3 1 0.4800 7.82E+00

4 1 0.4413 4.37E+00

5 1 0.4210 2.53E+00

6 1 0.4128 1.49E+00

7 1 0.4128 8.74E-01

8 1 0.4145 5.12E-01

9 1 0.4179 2.98E-01

10 1 0.4232 1.72E-01

11 1 1.0000 0.00E+00

Solution found - Residual lower than absolute tolerance

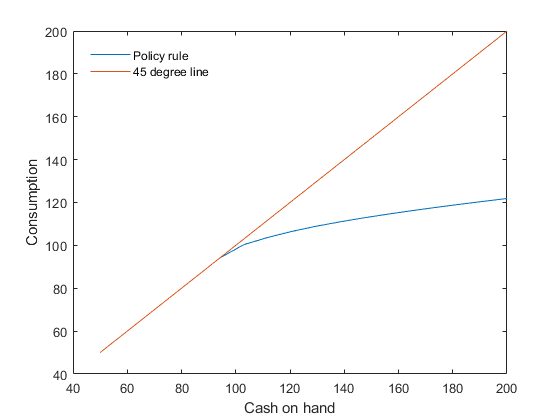

Plot the decision rule

figure plot(s,[x s]) legend('Policy rule','45 degree line') legend('Location','NorthWest') legend('boxoff') xlabel('Cash on hand') ylabel('Consumption')

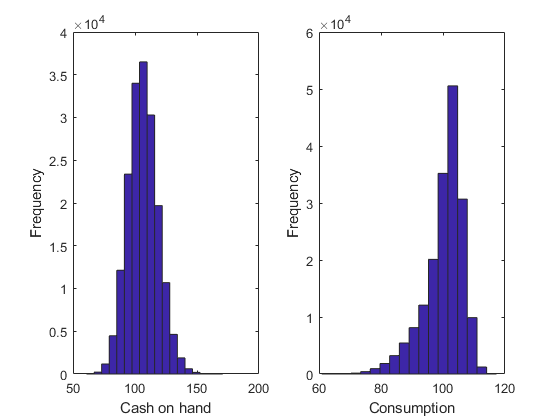

Simulate the model

[~,~,~,stat] = recsSimul(model,interp,model.sss(ones(1000,1),:),200); subplot(1,2,1) xlabel('Cash on hand') ylabel('Frequency') subplot(1,2,2) xlabel('Consumption') ylabel('Frequency')

Statistics from simulated variables (excluding the first 20 observations):

Moments

Mean StdDev Skewness Kurtosis Min Max pLB pUB

______ ______ ________ ________ ______ ______ ___ ______

X 106.46 11.993 0.21404 3.1685 60.906 170.81 NaN NaN

C 100.3 6.3358 -1.2064 4.8722 60.904 117.21 0 12.001

Correlation

X C

_______ _______

X 1 0.94694

C 0.94694 1

Autocorrelation

T1 T2 T3 T4 T5

_______ _______ _______ ________ ________

X 0.50523 0.26951 0.14663 0.073857 0.035042

C 0.38738 0.19105 0.10297 0.049875 0.022239

References

Deaton, A. (1991). Saving and liquidity constraints. Econometrica, 59(5), 1221-1248.