GRO1 Stochastic growth model

Contents

Model's structure

Response variable Consumption ( ).

).

State variable Capital stock ( ), Log of productivity (

), Log of productivity ( ).

).

Shock Innovation to productivity ( ).

).

Parameters Capital depreciation rate ( ), Discount factor (

), Discount factor ( ), Elasticity of intertemporal substitution (

), Elasticity of intertemporal substitution ( ), Capital share (

), Capital share ( ), Scale parameter (

), Scale parameter ( ).

).

Equilibrium equation

![$$C_{t}: C_{t}^{-\tau}=\beta\mathrm{E}_{t}\left[C_{t+1}^{-\tau}\left(1-\delta+a \alpha e^{Z_{t+1}}K_{t+1}^{\alpha-1}\right)\right].$$](gro1_eq17171729093805930249.png)

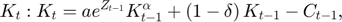

Transition equations

Writing the model

The model is defined in a Yaml file: gro1.yaml.

Create the model object

Mean and standard deviation of the shocks

Mu = 0; sigma = 0.007;

You generate the MATLAB model file and pack the model object with the following command

model = recsmodel('gro1.yaml',... struct('Mu',Mu,'Sigma',sigma^2,'order',5));

Deterministic steady state (different from first guess, max(|delta|)=1.75094e-08)

State variables:

K Z

_ _________

1 3.216e-22

Response variables:

C

_______

0.19928

Expectations variables:

E

______

26.505

This command creates a MATLAB file, gro1model.m, containing the definition the model and all its Jacobians from the human readable file gro1.yaml.

Define approximation space using Chebyshev polynomials

Degree of approximation

order = [10 10];

Limits of the state space

smin = [0.85*model.sss(1) min(model.shocks.e)*4]; smax = [1.15*model.sss(1) max(model.shocks.e)*4];

[interp,s] = recsinterpinit(order,smin,smax,'cheb');

Find a first guess through first-order approximation around the steady state

[interp,x] = recsFirstGuess(interp,model,s,model.sss,model.xss);

Define options

With high order Chebyshev polynomials, extrapolation outside the state space should not be allowed to prevent explosive values.

options = struct('reesolver','krylov',... 'extrapolate',0 ,... 'accuracy' ,1);

Solve for rational expectations

interp = recsSolveREE(interp,model,s,x,options);

Newton-Krylov solver

Major Residual Minor 1 Relative res. Minor 2

0 1.32E-04 0 1.00E+00 0 (Input point)

1 2.70E-05 1 2.04E-01 0

2 1.88E-05 1 6.97E-01 0

3 2.80E-06 2 1.49E-01 0

4 4.97E-08 3 1.78E-02 0

5 1.12E-09 4 2.26E-02 0

Simulate the model

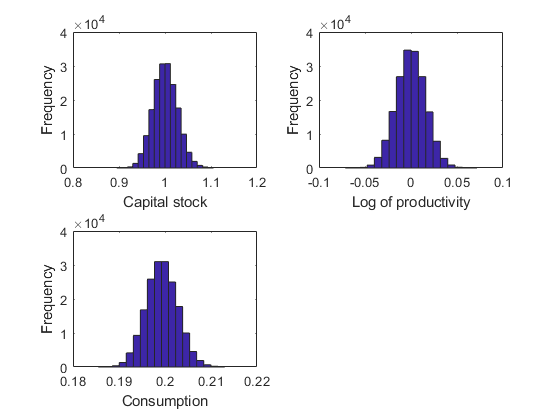

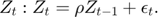

[~,~,~,stat] = recsSimul(model,interp,model.sss(ones(1000,1),:),200,[],options); subplot(2,2,1) xlabel('Capital stock') ylabel('Frequency') subplot(2,2,2) xlabel('Log of productivity') ylabel('Frequency') subplot(2,2,3) xlabel('Consumption') ylabel('Frequency')

Statistics from simulated variables (excluding the first 20 observations):

Moments

Mean StdDev Skewness Kurtosis Min Max pLB pUB

___________ _________ _________ ________ _________ ________ ___ ___

K 1.0007 0.026494 0.11057 3.0062 0.89474 1.1053 NaN NaN

Z -3.3217e-05 0.015946 0.0022828 2.9987 -0.071637 0.071787 NaN NaN

C 0.19934 0.0034279 0.078804 2.989 0.18546 0.21301 0 0

Correlation

K Z C

_______ _______ _______

K 1 0.52294 0.94816

Z 0.52294 1 0.76667

C 0.94816 0.76667 1

Autocorrelation

T1 T2 T3 T4 T5

_______ _______ _______ _______ _______

K 0.99396 0.98004 0.95955 0.93366 0.90339

Z 0.8772 0.7681 0.67239 0.58658 0.51118

C 0.9733 0.94265 0.90909 0.87289 0.83506

Accuracy of the solution

Equilibrium equation error (in log10 units)

Max Mean

-2.9649 -4.9531