GRO2 Stochastic growth model with irreversible investment

This is an implementation of the model in Christiano and Fisher (2000).

Contents

Model's structure

Response variable Consumption ( ), Investment (

), Investment ( ), Lagrange multiplier (

), Lagrange multiplier ( ).

).

State variable Capital stock ( ), Log of productivity (

), Log of productivity ( ).

).

Shock Innovation to productivity ( ).

).

Parameters Capital depreciation rate ( ), Discount factor (

), Discount factor ( ), Elasticity of intertemporal substitution (

), Elasticity of intertemporal substitution ( ), Capital share (

), Capital share ( ), Scale parameter (

), Scale parameter ( ).

).

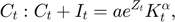

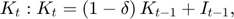

Equilibrium equations

![$$\mu_{t}: \mu_{t}+\beta\mathrm{E}_{t}\left[a \alpha e^{Z_{t+1}}K_{t+1}^{\alpha-1}C_{t+1}^{-\tau}-\mu_{t+1}\left(1-\delta\right)\right]=0.$$](gro2_eq16282029772531919626.png)

Transition equations

Writing the model

The model is defined in a Yaml file: gro2.yaml.

Create the model object

Mean and standard deviation of the shocks

Mu = 0; sigma = 0.04;

model = recsmodel('gro2.yaml',... struct('Mu',Mu,'Sigma',sigma^2,'order',7));

Deterministic steady state (different from first guess, max(|delta|)=4.52137)

State variables:

K Z

_ ___________

1 -3.5818e-19

Response variables:

C I Mu

_______ ______ _______

0.22117 0.0196 -4.5214

Expectations variables:

E

______

4.7593

This command creates a MATLAB file, gro2model.m, containing the definition the model and all its Jacobians from the human readable file gro2.yaml.

Define approximation space

Degree of approximation

order = 24;

Limits of the state space

smin = [0.47*model.sss(1) min(model.shocks.e)*3.5]; smax = [1.72*model.sss(1) max(model.shocks.e)*3.5];

[interp,s] = recsinterpinit(order,smin,smax);

Define options

options = struct('fgmethod','perturbation',... 'reesolver','mixed');

Find a first guess through first-order approximation around the steady state

[interp,x] = recsFirstGuess(interp,model,s,model.sss,model.xss,options);

Solve for rational expectations

interp = recsSolveREE(interp,model,s,x,options);

Successive approximation

Major Minor Lipschitz Residual

0 0 2.83E+00 (Input point)

1 1 0.5633 1.55E+00

2 1 0.2903 1.26E+00

3 1 0.2548 1.07E+00

4 1 0.2091 9.38E-01

5 1 0.1813 8.32E-01

6 1 0.1673 7.39E-01

7 1 0.1639 6.52E-01

8 1 0.1603 5.67E-01

9 1 0.1698 4.84E-01

10 1 0.1718 4.08E-01

Too many iterations

Newton-Krylov solver

Major Residual Minor 1 Relative res. Minor 2

0 4.08E-01 0 1.00E+00 0 (Input point)

1 2.00E-01 1 4.91E-01 0

2 5.21E-02 1 2.60E-01 0

3 1.61E-02 2 3.09E-01 0

4 1.97E-03 3 1.22E-01 0

5 1.74E-05 11 8.87E-03 0

6 3.94E-09 10 2.26E-04 0

Simulate the model

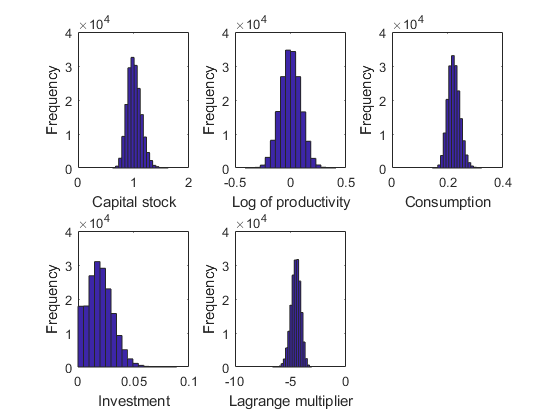

[~,~,~,stat] = recsSimul(model,interp,model.sss(ones(1000,1),:),200); subplot(2,3,1) xlabel('Capital stock') ylabel('Frequency') subplot(2,3,2) xlabel('Log of productivity') ylabel('Frequency') subplot(2,3,3) xlabel('Consumption') ylabel('Frequency') subplot(2,3,4) xlabel('Investment') ylabel('Frequency') subplot(2,3,5) xlabel('Lagrange multiplier') ylabel('Frequency')

Statistics from simulated variables (excluding the first 20 observations):

Moments

Mean StdDev Skewness Kurtosis Min Max pLB pUB

___________ ________ ________ ________ ________ ________ ______ ___

K 1.0134 0.12252 0.40204 3.247 0.62059 1.6243 NaN NaN

Z -0.00018851 0.091124 0.002673 2.9985 -0.40935 0.41021 NaN NaN

C 0.22292 0.021423 0.31764 3.1586 0.14486 0.32353 0 0

I 0.019893 0.011407 0.44382 3.1573 0 0.089075 1.8717 0

Mu -4.5226 0.42991 -0.23494 3.0625 -6.6269 -3.0908 0 0

Correlation

K Z C I Mu

_______ _______ _______ _______ _______

K 1 0.61079 0.95318 0.17578 0.95006

Z 0.61079 1 0.81869 0.87473 0.80603

C 0.95318 0.81869 1 0.45494 0.98932

I 0.17578 0.87473 0.45494 1 0.43491

Mu 0.95006 0.80603 0.98932 0.43491 1

Autocorrelation

T1 T2 T3 T4 T5

_______ _______ _______ _______ _______

K 0.99221 0.97359 0.9463 0.91223 0.87296

Z 0.87718 0.76803 0.67235 0.58657 0.51116

C 0.97464 0.94237 0.90489 0.8632 0.81874

I 0.81983 0.66701 0.53849 0.42835 0.33572

Mu 0.97783 0.94799 0.91239 0.87211 0.82869