STO1 Competitive storage model

This model is a standard competitive storage model with supply reaction. Its setting is close to Wright and Williams (1982).

Contents

Model's structure

Response variables Storage ( ), Planned production (

), Planned production ( ) and Price (

) and Price ( ).

).

State variable Availability ( ).

).

Shock Productivity shocks ( ).

).

Parameters Unit physical storage cost ( ), Depreciation share (

), Depreciation share ( ), Interest rate (

), Interest rate ( ), Scale parameter for the production cost function (

), Scale parameter for the production cost function ( ), Inverse of supply elasticity (

), Inverse of supply elasticity ( ) and Demand price elasticity (

) and Demand price elasticity ( ).

).

Equilibrium equations

Transition equation

Writing the model

The model is defined in a Yaml file: sto1.yaml.

Create the model object

Mu = 1; sigma = 0.05;

model = recsmodel('sto1.yaml',struct('Mu',Mu,'Sigma',sigma^2,'order',7));

Deterministic steady state (equal to first guess)

State variables:

A

_

1

Response variables:

S H P

_ _ _

0 1 1

Expectations variables:

EP EPe

__ ___

1 1

Define approximation space

[interp,s] = recsinterpinit(40,model.sss*0.7,model.sss*1.5);

Find a first guess through the perfect foresight solution

interp = recsFirstGuess(interp,model,s,model.sss,model.xss,struct('T',5));

Solve for rational expectations

interp = recsSolveREE(interp,model);

Successive approximation

Major Minor Lipschitz Residual

0 0 7.18E-02 (Input point)

1 1 0.7774 4.27E-02

2 1 0.6246 2.88E-02

3 1 0.5941 1.22E-02

4 1 0.6840 3.88E-03

5 1 0.7230 1.08E-03

6 1 0.7359 2.84E-04

7 1 0.7394 7.41E-05

8 1 0.7408 1.92E-05

9 1 0.7412 4.97E-06

10 1 0.7412 1.29E-06

11 1 0.7412 3.33E-07

12 1 0.7432 8.58E-08

13 1 0.8677 1.86E-08

14 1 1.0000 0.00E+00

Solution found - Residual lower than absolute tolerance

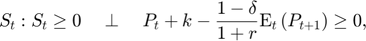

Plot the decision rules

recsDecisionRules(model,interp,[],[],[],struct('simulmethod','solve')); subplot(2,2,1) xlabel('Availability') ylabel('Storage') subplot(2,2,2) xlabel('Availability') ylabel('Planned production') subplot(2,2,3) xlabel('Availability') ylabel('Price')

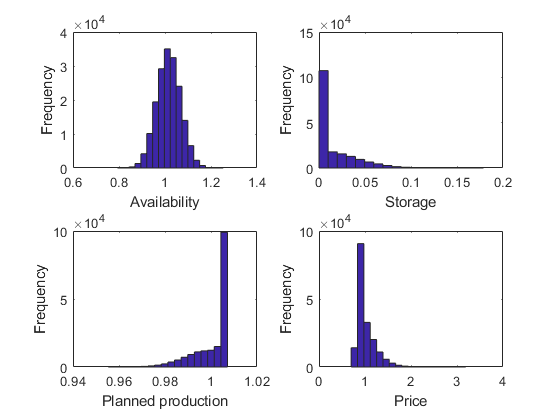

Simulate the model

[ssim,~,~,stat] = recsSimul(model,interp,model.sss(ones(1000,1),:),200); subplot(2,2,1) xlabel('Availability') ylabel('Frequency') subplot(2,2,2) xlabel('Storage') ylabel('Frequency') subplot(2,2,3) xlabel('Planned production') ylabel('Frequency') subplot(2,2,4) xlabel('Price') ylabel('Frequency')

Statistics from simulated variables (excluding the first 20 observations):

Moments

Mean StdDev Skewness Kurtosis Min Max pLB pUB

________ _________ ________ ________ _______ _______ ______ ___

A 1.0162 0.051825 0.019719 2.9954 0.79312 1.2528 NaN NaN

S 0.015508 0.021954 1.6549 5.5816 0 0.17869 23.972 0

H 1.001 0.0080711 -1.4145 4.3785 0.9553 1.0072 0 0

P 1.0164 0.20256 1.8699 7.7434 0.69929 3.1864 0 0

Correlation

A S H P

________ ________ ________ _______

A 1 0.86642 -0.87774 -0.9043

S 0.86642 1 -0.99794 -0.578

H -0.87774 -0.99794 1 0.59579

P -0.9043 -0.578 0.59579 1

Autocorrelation

T1 T2 T3 T4 T5

_______ ________ _________ __________ __________

A 0.21258 0.041476 0.005918 -0.0079829 -0.0089553

S 0.24111 0.051096 0.0054768 -0.0092697 -0.010646

H 0.23996 0.050647 0.0056397 -0.0090575 -0.010316

P 0.11904 0.016731 0.002795 -0.0061893 -0.0071728

Assess solution accuracy

recsAccuracy(model,interp,ssim);

Accuracy of the solution

Equilibrium equation error (in log10 units)

Max Mean

-2.2986 -3.1471

-2.7699 -3.7235

-3.3881 -4.3433