STO2 Competitive storage with floor-price backed by public storage

This model is close to one of the models presented in Wright and Williams (1988).

Contents

Model's structure

Response variables Speculative storage ( ), Public storage (

), Public storage ( ), Planned production (

), Planned production ( ) and Price (

) and Price ( ).

).

State variable Availability ( ).

).

Shock Productivity shocks ( ).

).

Parameters Unit physical storage cost ( ), Depreciation share (

), Depreciation share ( ), Interest rate (

), Interest rate ( ), Scale parameter for the production cost function (

), Scale parameter for the production cost function ( ), Inverse of supply elasticity (

), Inverse of supply elasticity ( ), Demand price elasticity (

), Demand price elasticity ( ), Floor price (

), Floor price ( ) and Capacity constraint on public stock (

) and Capacity constraint on public stock ( ).

).

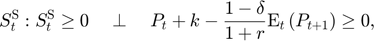

Equilibrium equations

Transition equation

Writing the model

The model is defined in a Yaml file: sto2.yaml.

Create the model object

Mu = 1; sigma = 0.05; model = recsmodel('sto2.yaml',struct('Mu',Mu,'Sigma',sigma^2,'order',7));

Deterministic steady state (different from first guess, max(|delta|)=0.392101)

State variables:

A

______

1.3921

Response variables:

S H P Sg

__________ _____ ____ _______

6.0863e-15 1.004 1.02 0.39605

Expectations variables:

EP EPe

____ ____

1.02 1.02

Define approximation space

[interp,s] = recsinterpinit(50,0.7,2);

Find a first guess through the perfect foresight solution

interp = recsFirstGuess(interp,model,s,model.sss,model.xss,struct('T',5));

Solve for rational expectations

[interp,x] = recsSolveREE(interp,model,s);

Successive approximation

Major Minor Lipschitz Residual

0 0 3.02E-02 (Input point)

1 1 1.0269 1.39E-02

2 1 0.9062 8.27E-03

3 1 0.9942 1.07E-03

4 1 1.0897 5.32E-04

5 1 0.7831 1.17E-04

6 1 0.8366 1.91E-05

7 1 0.8449 2.97E-06

8 1 0.8459 4.57E-07

9 1 0.8460 7.04E-08

10 1 1.0000 0.00E+00

Solution found - Residual lower than absolute tolerance

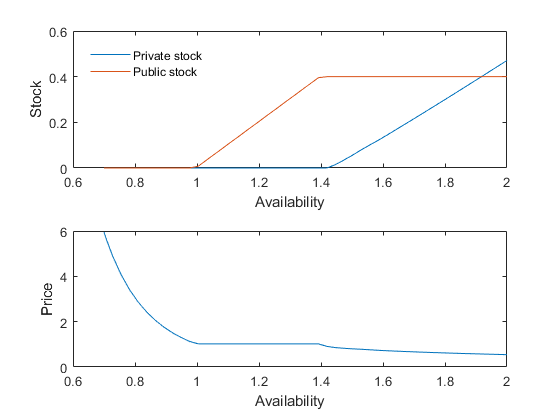

Plot storage and price rules

subplot(2,1,1) plot(s,x(:,[1 4])) leg = legend('Private stock','Public stock'); set(leg,'Location','NorthWest') set(leg,'Box','off') xlabel('Availability') ylabel('Stock') subplot(2,1,2) plot(s,x(:,3)) xlabel('Availability') ylabel('Price')