STO4 Competitive storage with price-band backed by public storage

This model is an extension of Miranda and Helmberger (1988) to include a capacity constraint on the public stock level (see also Gouel 2013).

Contents

Model's structure

Response variables Speculative storage ( ), Increase in public stock level (

), Increase in public stock level ( ), Decrease in public stock level (

), Decrease in public stock level ( ), Planned production (

), Planned production ( ) and Price (

) and Price ( ).

).

State variable Availability ( ) and Public stock (

) and Public stock ( ).

).

Shock Productivity shocks ( ).

).

Parameters Unit physical storage cost ( ), Interest rate (

), Interest rate ( ), Scale parameter for the production cost function (

), Scale parameter for the production cost function ( ), Inverse of supply elasticity (

), Inverse of supply elasticity ( ), Demand price elasticity (

), Demand price elasticity ( ), Floor price (

), Floor price ( ), Ceiling price (

), Ceiling price ( ) and Capacity constraint on public stock (

) and Capacity constraint on public stock ( ).

).

Equilibrium equations

Transition equation

Writing the model

The model is defined in a Yaml file: sto4.yaml.

Create the model object

Mu = 1; sigma = 0.05; model = recsmodel('sto4.yaml',struct('Mu',Mu,'Sigma',sigma^2,'order',7));

Deterministic steady state (equal to first guess)

State variables:

A Sg

_ ___

1 0.4

Response variables:

S H P DSgp DSgm

_ _ _ ____ ____

0 1 1 0 0

Expectations variables:

EP EPe

__ ___

1 1

Sgbar = model.params(end-1);

Multiple steady states

In this model, there is no stock depreciation. This assumption implies that there are multiple steady states: as long as the steady-state price is between the floor and ceiling prices, any public stock level between 0 and  is a steady state. Actually, the steady-state response variables are unique, only the public stock level is indeterminate as we can see in the examples below:

is a steady state. Actually, the steady-state response variables are unique, only the public stock level is indeterminate as we can see in the examples below:

[sss1,xss1] = recsSS(model,[1 0],model.xss);

Deterministic steady state (equal to first guess)

State variables:

A Sg

_ __

1 0

Response variables:

S H P DSgp DSgm

_ _ _ ____ ____

0 1 1 0 0

Expectations variables:

EP EPe

__ ___

1 1

[sss2,xss2] = recsSS(model,[1 0.2],model.xss);

Deterministic steady state (equal to first guess)

State variables:

A Sg

_ ___

1 0.2

Response variables:

S H P DSgp DSgm

_ _ _ ____ ____

0 1 1 0 0

Expectations variables:

EP EPe

__ ___

1 1

Define approximation space

[interp,s] = recsinterpinit(20,[0.74 0],[1.4 Sgbar]);

Find a first guess through the perfect foresight solution

interp = recsFirstGuess(interp,model,s,model.sss,model.xss,struct('T',5));

Solve for rational expectations

[interp,x] = recsSolveREE(interp,model,s);

Successive approximation

Major Minor Lipschitz Residual

0 0 1.50E-01 (Input point)

1 1 0.8672 6.27E-02

2 1 0.6394 2.84E-02

3 1 0.6901 8.93E-03

4 1 0.7305 2.41E-03

5 1 0.7453 6.14E-04

6 1 0.7509 1.53E-04

7 1 0.7528 3.78E-05

8 1 0.7535 9.32E-06

9 1 0.7537 2.30E-06

10 1 0.7540 5.67E-07

11 1 0.7598 1.40E-07

12 1 0.9398 3.24E-08

13 1 1.0000 0.00E+00

Solution found - Residual lower than absolute tolerance

Simulate the model

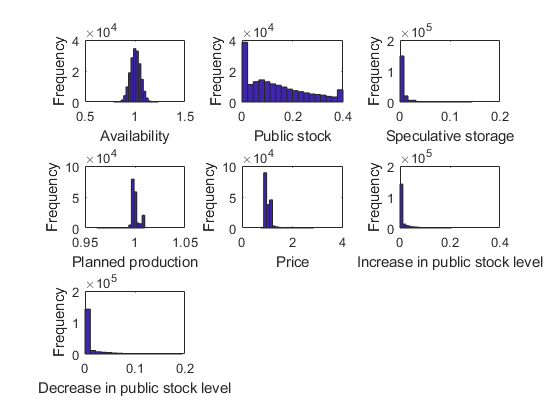

options.stat = 1; recsSimul(model,interp,repmat([1 0],1E3,1),200,[],options); subplot(3,3,1) xlabel('Availability') ylabel('Frequency') subplot(3,3,2) xlabel('Public stock') ylabel('Frequency') subplot(3,3,3) xlabel('Speculative storage') ylabel('Frequency') subplot(3,3,4) xlabel('Planned production') ylabel('Frequency') subplot(3,3,5) xlabel('Price') ylabel('Frequency') subplot(3,3,6) xlabel('Increase in public stock level') ylabel('Frequency') subplot(3,3,7) xlabel('Decrease in public stock level') ylabel('Frequency')

Statistics from simulated variables (excluding the first 20 observations):

Moments

Mean StdDev Skewness Kurtosis Min Max pLB pUB

_________ _________ _________ ________ _______ _______ ______ ______

A 1.004 0.050486 0.0050016 2.9912 0.78697 1.2316 NaN NaN

Sg 0.13528 0.1159 0.67697 2.4411 0 0.4 NaN NaN

S 0.0040365 0.0075183 3.7378 27.244 0 0.1444 35.415 0

H 0.99999 0.0039457 0.54691 6.3107 0.96172 1.0097 0 0

P 1.007 0.12142 2.1476 13.615 0.74116 2.8374 0 0

DSgp 0.0092738 0.019729 2.8634 12.165 0 0.20619 38.557 1.0844

DSgm 0.0089268 0.018965 2.7876 11.426 0 0.19424 26.427 9.2961

Correlation

A Sg S H P DSgp DSgm

_________ _________ ________ ________ ________ _________ ________

A 1 -0.052898 0.57932 -0.52389 -0.81646 0.71504 -0.69501

Sg -0.052898 1 -0.10746 -0.51905 -0.09671 -0.048125 0.15038

S 0.57932 -0.10746 1 -0.47524 -0.47195 0.28753 -0.24819

H -0.52389 -0.51905 -0.47524 1 0.58195 -0.36285 0.1295

P -0.81646 -0.09671 -0.47195 0.58195 1 -0.40827 0.42106

DSgp 0.71504 -0.048125 0.28753 -0.36285 -0.40827 1 -0.21875

DSgm -0.69501 0.15038 -0.24819 0.1295 0.42106 -0.21875 1

Autocorrelation

T1 T2 T3 T4 T5

________ __________ __________ _________ __________

A 0.041787 -0.02014 -0.015863 -0.02007 -0.016676

Sg 0.93562 0.87078 0.81071 0.75463 0.7032

S 0.16836 0.067865 0.049235 0.035641 0.030582

H 0.49457 0.37386 0.31506 0.26788 0.23226

P 0.079151 0.018209 0.015877 0.01248 0.0091157

DSgp 0.02324 -0.0068244 -0.0071192 -0.013707 -0.010108

DSgm 0.015919 -0.0061996 -0.0038683 -0.010361 -0.0059664