STO6 Quarterly storage model with annual inelastic supply

This model represents the market of a storable commodity that is produced once a year and stored for a year-long consumption. Supply is stochastic and inelastic. Except for its distribution, no information about the coming harvest is known.

Contents

Model's structure

Writing the model

The model is defined in a Yaml file: sto6.yaml.

Create the model object

model = recsmodel('sto6.yaml',struct('Mu',0,'Sigma',0.05^2,'order',5));

Deterministic steady state (different from first guess, max(|delta|)=0.0961408)

State variables:

A1

__

4

Response variables:

S1 S2 S3 S4 P1 P2 P3 P4 A2 A3 A4

______ ______ _______ __________ _______ ______ ______ ______ ______ ______ _______

2.9964 1.9854 0.98671 1.9961e-18 0.98214 1.0197 1.0577 1.0961 2.9815 1.9756 0.98181

Expectations variables:

EP

_______

0.98214

Define approximation space

interp = recsinterpinit(50,model.sss*0.7,model.sss*1.5);

Find a first guess through the perfect foresight solution

interp = recsFirstGuess(interp,model);

Solve for rational expectations

[interp,Xcat] = recsSolveREE(interp,model);

Successive approximation

Major Minor Lipschitz Residual

0 0 7.61E-02 (Input point)

1 1 0.7086 4.93E-02

2 1 0.5706 3.31E-02

3 1 0.5590 1.55E-02

4 1 0.6546 5.38E-03

5 1 0.6941 1.65E-03

6 1 0.7079 4.81E-04

7 1 0.7122 1.38E-04

8 1 0.7151 3.94E-05

9 1 0.7159 1.12E-05

10 1 0.7163 3.18E-06

11 1 0.7161 9.03E-07

12 1 0.7157 2.57E-07

13 1 1.0000 0.00E+00

Solution found - Residual lower than absolute tolerance

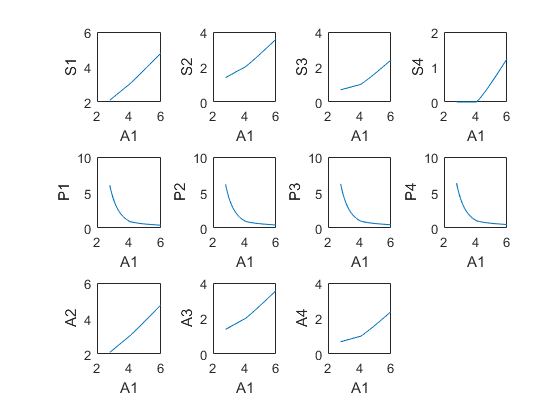

Plot the decision rules

recsDecisionRules(model,interp,[],[],[],struct('simulmethod','solve')); for i=1:model.dim{2} subplot(3,4,i) xlabel(model.symbols.states{1}); ylabel(model.symbols.controls{i}); end

Simulate the model

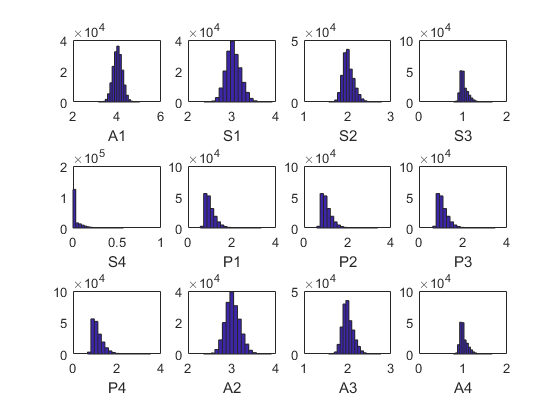

[ssim,~,~,stat] = recsSimul(model,interp,model.sss(ones(1000,1),:),200,[],... struct('accuracy',1)); subplot(3,4,1) xlabel(model.symbols.states{1}); for i=1:model.dim{2} subplot(3,4,i+1) xlabel(model.symbols.controls{i}); end

Statistics from simulated variables (excluding the first 20 observations):

Moments

Mean StdDev Skewness Kurtosis Min Max pLB pUB

________ ________ ________ ________ _______ _______ ______ ___

A1 4.0339 0.20819 0.045874 3.0194 3.1503 5.0401 NaN NaN

S1 3.0303 0.1669 0.25675 3.1639 2.3639 3.9152 0 0

S2 2.0193 0.12679 0.60361 3.5534 1.5689 2.7836 0 0

S3 1.0207 0.089673 1.2152 4.7192 0.78099 1.6694 0 0

S4 0.034219 0.058308 2.1537 8.0546 0 0.57222 27.647 0

P1 1.0112 0.23947 1.4769 6.0874 0.55524 3.3258 0 0

P2 1.0491 0.24245 1.4769 6.0874 0.58746 3.3925 0 0

P3 1.0875 0.24546 1.4769 6.0874 0.62008 3.46 0 0

P4 1.1263 0.24852 1.4769 6.0874 0.65311 3.5283 0 0

A2 3.0153 0.16607 0.25675 3.1639 2.3522 3.8958 0 0

A3 2.0093 0.12616 0.60361 3.5534 1.5612 2.7697 0 0

A4 1.0156 0.089228 1.2152 4.7192 0.77712 1.6612 0 0

Correlation

A1 S1 S2 S3 S4 P1 P2 P3 P4 A2 A3 A4

________ ________ ________ ________ ________ ________ ________ ________ ________ ________ ________ ________

A1 1 0.99865 0.9908 0.95879 0.81734 -0.93754 -0.93754 -0.93754 -0.93754 0.99865 0.9908 0.95879

S1 0.99865 1 0.99649 0.97225 0.84617 -0.91938 -0.91938 -0.91938 -0.91938 1 0.99649 0.97225

S2 0.9908 0.99649 1 0.98842 0.88781 -0.88482 -0.88482 -0.88482 -0.88482 0.99649 1 0.98842

S3 0.95879 0.97225 0.98842 1 0.94735 -0.80621 -0.80621 -0.80621 -0.80621 0.97225 0.98842 1

S4 0.81734 0.84617 0.88781 0.94735 1 -0.57807 -0.57807 -0.57807 -0.57807 0.84617 0.88781 0.94735

P1 -0.93754 -0.91938 -0.88482 -0.80621 -0.57807 1 1 1 1 -0.91938 -0.88482 -0.80621

P2 -0.93754 -0.91938 -0.88482 -0.80621 -0.57807 1 1 1 1 -0.91938 -0.88482 -0.80621

P3 -0.93754 -0.91938 -0.88482 -0.80621 -0.57807 1 1 1 1 -0.91938 -0.88482 -0.80621

P4 -0.93754 -0.91938 -0.88482 -0.80621 -0.57807 1 1 1 1 -0.91938 -0.88482 -0.80621

A2 0.99865 1 0.99649 0.97225 0.84617 -0.91938 -0.91938 -0.91938 -0.91938 1 0.99649 0.97225

A3 0.9908 0.99649 1 0.98842 0.88781 -0.88482 -0.88482 -0.88482 -0.88482 0.99649 1 0.98842

A4 0.95879 0.97225 0.98842 1 0.94735 -0.80621 -0.80621 -0.80621 -0.80621 0.97225 0.98842 1

Autocorrelation

T1 T2 T3 T4 T5

_______ ________ _________ __________ __________

A1 0.21648 0.047568 0.0089635 -0.006843 -0.008623

S1 0.22687 0.050773 0.0094296 -0.0070417 -0.0089489

S2 0.24164 0.055368 0.010032 -0.0073559 -0.0094548

S3 0.2611 0.061608 0.010651 -0.0078625 -0.010267

S4 0.26473 0.064139 0.0099399 -0.0083125 -0.011228

P1 0.13189 0.022645 0.0049882 -0.0058688 -0.0070509

P2 0.13189 0.022645 0.0049882 -0.0058688 -0.0070509

P3 0.13189 0.022645 0.0049882 -0.0058688 -0.0070509

P4 0.13189 0.022645 0.0049882 -0.0058688 -0.0070509

A2 0.22687 0.050773 0.0094296 -0.0070417 -0.0089489

A3 0.24164 0.055368 0.010032 -0.0073559 -0.0094548

A4 0.2611 0.061608 0.010651 -0.0078625 -0.010267

Accuracy of the solution

Equilibrium equation error (in log10 units)

Max Mean

-8.0300 -8.6895

-8.3915 -9.3227

-8.5612 -9.2494

-2.1736 -3.1645

-4.6787 -5.3781

-4.7071 -5.4060

-4.7345 -5.4329

-3.3738 -4.4109

-14.6536 -15.4064

-14.8754 -15.6120

-15.1764 -15.8576