GRO3 Stochastic growth model with recursive preferences and stochastic volatility (SV)

This model is similar to Caldara et al. (2012).

Contents

- Model's structure

- Writing the model

- Create the model object

- Define approximation space using Chebyshev polynomials

- Find a first guess through first-order approximation around the steady state

- Define options

- Solve for rational expectations

- Use simple continuation method to solve for higher values of risk aversion

- Simulate the model

- References

Model's structure

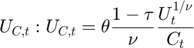

Response variable Consumption ( ), Labor (

), Labor ( ), Marginal utility with respect to consumption (

), Marginal utility with respect to consumption ( ), Instantaneous utility (

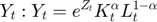

), Instantaneous utility ( ), Production (

), Production ( ), Utility (

), Utility ( ).

).

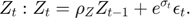

State variable Capital stock ( ), Log of productivity (

), Log of productivity ( ), Log of productivity volatility (

), Log of productivity volatility ( ).

).

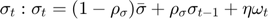

Shock Innovation to productivity ( ), Innovation to productivity volatility (

), Innovation to productivity volatility ( ).

).

Parameters Capital depreciation rate ( ), Discount factor (

), Discount factor ( ), Index of deviation from CRRA utility (

), Index of deviation from CRRA utility ( ), Risk-aversion parameter (

), Risk-aversion parameter ( ), Capital share (

), Capital share ( ), Share of consumption in utility (

), Share of consumption in utility ( ), Persistence of log-productivity (

), Persistence of log-productivity ( ), Persistence of SV (

), Persistence of SV ( ), Unconditional mean of SV (

), Unconditional mean of SV ( ), Standard deviation of SV (

), Standard deviation of SV ( ).

).

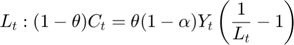

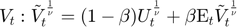

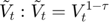

Equilibrium equation

![$$C_{t}: U_{C,t}=\beta\left(\mathrm{E}_{t}\tilde{V}_{t+1}\right)^{\left(\frac{1}{\theta}-1\right)}\mathrm{E}_{t}\left[\tilde{V}_{t+1}^{\frac{\theta-1}{\theta}}U_{C,t+1}\left(1-\delta+ \alpha e^{Z_{t+1}}K_{t+1}^{\alpha-1}L_{t+1}^{\alpha-1}\right)\right].$$](gro3_eq09868040942710534610.png)

![$$U_t: U_t = \left[C_t^{\theta}(1-L_t)^{1-\theta}\right]^{1-\tau}$$](gro3_eq09182882273380980026.png)

Transition equations

Writing the model

The model is defined in a Yaml file: gro3.yaml.

Create the model object

model = recsmodel('gro3.yaml',struct('Mu',[0 0],'Sigma',eye(2),'order',5));

Deterministic steady state (different from first guess, max(|delta|)=0.74174)

State variables:

K Z Sigma

______ ___________ _______

9.3926 -2.3527e-18 -4.9618

Response variables:

C L Uc U Y V Vt

_______ _______ _______ _______ _______ _______ _______

0.71389 0.32835 0.20716 0.82851 0.89799 0.68644 0.82851

Expectations variables:

EC EVt

_______ _______

0.20904 0.82851

Define approximation space using Chebyshev polynomials

smin = [0.85*model.sss(1) -0.11 log(0.007)*1.15]; smax = [1.20*model.sss(1) 0.11 log(0.007)*0.85];

[interp,s] = recsinterpinit(4,smin,smax,'cheb');

Find a first guess through first-order approximation around the steady state

[interp,x] = recsFirstGuess(interp,model,s);

Define options

options = struct('reemethod','1-step',... 'accuracy' ,1,... 'stat' ,1);

Solve for rational expectations

[interp,x,z] = recsSolveREE(interp,model,s,x,options);

Use simple continuation method to solve for higher values of risk aversion

The procedure to solve for different parameters values has to be packed in a function. This is done in gro3problem.m.

type('gro3problem.m')

function [X,f,exitflag] = gro3problem(X,z)

% GRO3PROBLEM Solves the model GRO3 for different values of risk aversion and IES

[model,interp,s,x,options] = X{:};

tau = z(1);

Psi = z(2);

nu = (1-tau)/(1-1/Psi);

model.params(1) = tau;

model.params(end-1:end) = [nu Psi];

[interp,x,~,f,exitflag] = recsSolveREE(interp,model,s,x,options);

X = {model interp s x options};

This function requires as input the cell array X:

X = {model interp s x options};

The function SCP starts from the known solution with a low risk aversion to find in 2 steps the solution with an higher risk aversion:

X = SCP(X,[5 0.5],[0.5 1/0.5],@gro3problem,2);

[model,interp,s,x,options] = X{:};

Simulate the model

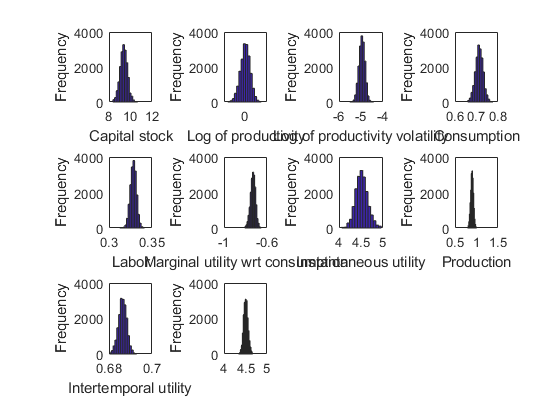

recsSimul(model,interp,model.sss(ones(100,1),:),200,[],options); subplot(3,4,1) xlabel('Capital stock') ylabel('Frequency') subplot(3,4,2) xlabel('Log of productivity') ylabel('Frequency') subplot(3,4,3) xlabel('Log of productivity volatility') ylabel('Frequency') subplot(3,4,4) xlabel('Consumption') ylabel('Frequency') subplot(3,4,5) xlabel('Labor') ylabel('Frequency') subplot(3,4,6) xlabel('Marginal utility wrt consumption') ylabel('Frequency') subplot(3,4,7) xlabel('Instantaneous utility') ylabel('Frequency') subplot(3,4,8) xlabel('Production') ylabel('Frequency') subplot(3,4,9) xlabel('Intertemporal utility') ylabel('Frequency') subplot(3,4,10) xlabel('') ylabel('Frequency')

Statistics from simulated variables (excluding the first 20 observations):

Moments

Mean StdDev Skewness Kurtosis Min Max pLB pUB

__________ _________ _________ ________ _________ ________ ___ ___

K 9.3726 0.3448 0.049759 3.1699 8.3612 10.667 NaN NaN

Z -0.0010056 0.022278 -0.12717 3.0141 -0.082602 0.072685 NaN NaN

Sigma -4.9589 0.13472 -0.079306 2.9814 -5.5057 -4.4161 NaN NaN

C 0.71284 0.017722 -0.020588 3.0338 0.65859 0.77676 0 0

L 0.32833 0.0035491 -0.086214 3.1091 0.3127 0.34121 0 0

Uc -0.73063 0.02345 -0.19052 3.0803 -0.80705 -0.65302 0 0

U 4.5172 0.13699 0.17868 3.1564 4.0595 4.959 0 0

Y 0.89685 0.032524 -0.01658 2.985 0.79054 1.0092 0 0

V 0.68632 0.0019234 -0.084775 3.0172 0.68021 0.69296 0 0

Vt 4.5073 0.050563 0.12709 3.0239 4.3367 4.6713 0 0

Correlation

K Z Sigma C L Uc U Y V Vt

________ ________ _________ ________ _________ ________ _________ ________ ________ _________

K 1 0.62478 0.046136 0.93156 0.20961 0.95867 -0.99857 0.73116 0.90316 -0.90282

Z 0.62478 1 0.026014 0.86584 0.89427 0.81844 -0.61567 0.98918 0.89935 -0.89944

Sigma 0.046136 0.026014 1 0.041852 0.0065812 0.043077 -0.046003 0.032588 0.040492 -0.040309

C 0.93156 0.86584 0.041852 1 0.55058 0.99528 -0.92653 0.92909 0.99737 -0.99717

L 0.20961 0.89427 0.0065812 0.55058 1 0.47492 -0.19805 0.82003 0.60862 -0.60875

Uc 0.95867 0.81844 0.043077 0.99528 0.47492 1 -0.95661 0.89201 0.98696 -0.98715

U -0.99857 -0.61567 -0.046003 -0.92653 -0.19805 -0.95661 1 -0.72241 -0.89796 0.89806

Y 0.73116 0.98918 0.032588 0.92909 0.82003 0.89201 -0.72241 1 0.95285 -0.95267

V 0.90316 0.89935 0.040492 0.99737 0.60862 0.98696 -0.89796 0.95285 1 -0.99995

Vt -0.90282 -0.89944 -0.040309 -0.99717 -0.60875 -0.98715 0.89806 -0.95267 -0.99995 1

Autocorrelation

T1 T2 T3 T4 T5

_______ _______ _______ _______ _______

K 0.99495 0.98532 0.97156 0.95413 0.93348

Z 0.92544 0.85546 0.78812 0.72396 0.66418

Sigma 0.87737 0.77009 0.67678 0.59627 0.52422

C 0.97313 0.94488 0.91479 0.88323 0.85085

L 0.90432 0.81569 0.73158 0.65263 0.58046

Uc 0.98183 0.96106 0.93766 0.91191 0.8844

U 0.99481 0.98507 0.97118 0.95365 0.93291

Y 0.93633 0.87596 0.81718 0.76052 0.70699

V 0.96592 0.9314 0.89576 0.85936 0.82292

Vt 0.96594 0.93144 0.89583 0.85946 0.82304

Accuracy of the solution

Equilibrium equation error (in log10 units)

Max Mean

-5.3396 -5.6612

-5.4924 -5.9614

-4.7854 -5.0195

-3.5812 -3.7903

-5.0962 -5.4858

-6.8940 -7.1197

-5.3354 -5.5530