STO6SP Quarterly storage model with informational subperiods and annual inelastic supply

This model represents the market of a storable commodity that is produced once a year and stored for a year-long consumption. Supply is stochastic and inelastic. Contrary to STO6, there are informational shocks about the coming harvest that allows stocks to be adjusted before the full harvest is known.

Contents

Writing the model

The model is defined in 4 Yaml files: sto6SP1.yaml, sto6SP2.yaml, sto6SP3.yaml, and sto6SP4.yaml.

Create the model object

model = recsmodelsp({'sto6SP1.yaml' 'sto6SP2.yaml' 'sto6SP3.yaml' 'sto6SP4.yaml'});

model.shocks = cell(model.nperiods,1);

model.bounds = cell(model.nperiods,2);

params = num2cell(model.params);

[k, delta, r, elastD, d] = params{:};

Define approximation space and shocks

clear('interp') sigma = [0.05 eps eps eps]; n = {50; 50; [50 5]; [50 5]}; smin = {2.8; 2.05; [1.35 -0.15]; [0.67 -0.21]}; smax = {6 ; 5.1 ; [3.9 0.15]; [2.72 0.21]}; for iperiod=1:model.nperiods % Shocks [model.shocks{iperiod}.e,model.shocks{iperiod}.w] = qnwnorm(5,0,sigma(iperiod)^2); model.shocks{iperiod}.funrand = @(nrep) randn(nrep,1)*sigma(iperiod); end % Interpolation structure interp.fspace = cellfun(@(N,SMIN,SMAX) fundefn('spli',N,SMIN,SMAX),n,smin,smax,... 'UniformOutput', false); interp.Phi = cellfun(@(FSPACE) funbasx(FSPACE),interp.fspace,... 'UniformOutput', false); interp.s = cellfun(@(FSPACE) gridmake(funnode(FSPACE)),interp.fspace,... 'UniformOutput', false); [model.ss.sss,model.ss.xss,model.ss.zss] = recsSSSP(model,{4; 3; [2 0]; [1 0]},... {[3 1]; [2 1]; [1 1]; [0 1]}); [s1,s2,s3,s4] = interp.s{:};

Deterministic steady state (different from first guess, max(|delta|)=0.0961408)

State variables:

A1 A2 A3 E3Prod A4 E4Prod

__ ______ ______ __________ _______ __________

4 2.9815 1.9756 1.4452e-19 0.98181 2.8904e-19

Response variables:

S1 P1 S2 P2 S3 P3 S4 P4

______ _______ ______ ______ _______ ______ __________ ______

2.9964 0.98214 1.9854 1.0197 0.98671 1.0577 1.3361e-18 1.0961

Expectations variables:

1.02 1.058 1.096 0.9821

Bounds

for iperiod=1:model.nperiods [LB,UB] = eval(['model.functions(iperiod).b(s' int2str(iperiod) '(1,:),params);']); model.bounds(iperiod,:) = {LB UB}; end

Provide a simple first guess

x4 = [zeros(size(s4,1),1) (s4(:,1)/d).^(1/elastD)]; x3 = [s3(:,1)/2 ((s3(:,1)/2)/d).^(1/elastD)]; x2 = [s2(:,1)*2/3 ((s2(:,1)/3)/d).^(1/elastD)]; x1 = [s1(:,1)*3/4 ((s1(:,1)/4)/d).^(1/elastD)];

Solve for rational expectations

[interp,X] = recsSolveREESP(model,interp,{x1; x2; x3; x4});

Successive approximation

Iter Residual

1 1.65E+01

2 2.49E+00

3 9.37E-01

4 3.33E-01

5 1.06E-01

6 2.99E-02

7 8.06E-03

8 2.21E-03

9 6.19E-04

10 1.75E-04

11 4.95E-05

12 1.41E-05

13 3.99E-06

14 1.13E-06

15 0.00E+00

Solution found - Residual lower than absolute tolerance

Compare STO6 and STO6SP when informational shocks are removed

if exist('Xcat','var') disp('Max absolute error in first subperiod storage and price (in log10)'); disp(log10(max(abs(Xcat(:,[1 5])-X{1})))); end

Introduced information shocks

sigma = [0.05/sqrt(3) eps 0.05/sqrt(3) 0.05/sqrt(3)]; for iperiod=1:model.nperiods % Shocks [model.shocks{iperiod}.e,model.shocks{iperiod}.w] = qnwnorm(5,0,sigma(iperiod)^2); model.shocks{iperiod}.funrand = @(nrep) randn(nrep,1)*sigma(iperiod); end [interp,X] = recsSolveREESP(model,interp,X); [ssim,xsim,esim,stat,fsim] = recsSimulSP(model,interp,repmat(4,1000,1),200);

Successive approximation

Iter Residual

1 4.74E-01

2 8.75E-02

3 3.68E-02

4 1.66E-02

5 6.33E-03

6 2.93E-03

7 1.30E-03

8 3.96E-04

9 9.84E-05

10 2.22E-05

11 4.79E-06

12 1.00E-06

13 0.00E+00

Solution found - Residual lower than absolute tolerance

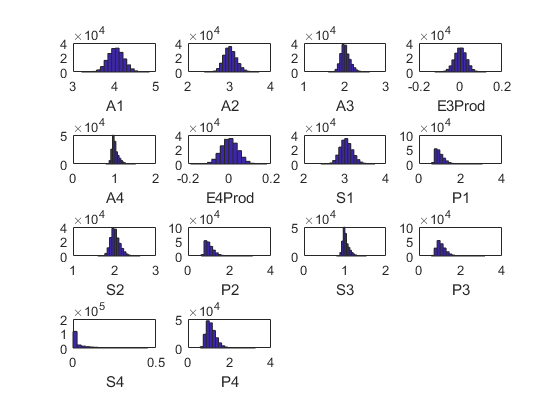

Statistics from simulated variables (excluding the first 20 observations):

Moments

Mean StdDev Skewness Kurtosis Min Max pLB pUB

__________ ________ __________ ________ ________ _______ ______ ___

A1 4.0357 0.19163 0.06465 2.9878 3.2041 4.8393 NaN NaN

A2 3.0171 0.15235 0.24829 3.1312 2.3922 3.713 NaN NaN

A3 2.011 0.11496 0.5569 3.5013 1.5876 2.604 NaN NaN

E3Prod 5.4327e-05 0.028824 -0.010354 3.0155 -0.12376 0.1235 NaN NaN

A4 1.017 0.080443 1.1514 4.662 0.79025 1.5146 NaN NaN

E4Prod 7.3159e-05 0.040745 -0.0014506 2.9953 -0.18843 0.18086 NaN NaN

S1 3.0321 0.15311 0.24829 3.1312 2.4041 3.7315 0 0

P1 1.0066 0.21537 1.2864 5.3842 0.59948 3.0522 0 0

S2 2.0211 0.11554 0.5569 3.5013 1.5955 2.617 0 0

P2 1.0444 0.21805 1.2863 5.384 0.63226 3.1154 0 0

S3 1.022 0.080844 1.1514 4.662 0.79419 1.5221 0 0

P3 1.0825 0.22712 1.114 4.9948 0.58569 3.1812 0 0

S4 0.035603 0.054246 2.1135 7.9023 0 0.45079 30.347 0

P4 1.1208 0.24161 0.95138 4.4806 0.58498 3.2488 0 0

Correlation

A1 A2 A3 E3Prod A4 E4Prod S1 P1 S2 P2 S3 P3 S4 P4

_________ _________ _________ __________ _________ __________ _________ __________ _________ __________ _________ ________ ________ ________

A1 1 0.99899 0.993 0.0024029 0.95869 0.0019429 0.99899 -0.95003 0.993 -0.95002 0.95869 -0.92397 0.75093 -0.87923

A2 0.99899 1 0.99731 0.0023972 0.969 0.0018378 1 -0.9359 0.99731 -0.93589 0.969 -0.91024 0.77226 -0.8661

A3 0.993 0.99731 1 0.0023819 0.98161 0.0016637 0.99731 -0.90876 1 -0.90874 0.98161 -0.88385 0.80368 -0.84089

E3Prod 0.0024029 0.0023972 0.0023819 1 -0.11245 0.70601 0.0023972 -0.0019278 0.0023819 -0.0019207 -0.11245 -0.20571 -0.29709 -0.18088

A4 0.95869 0.969 0.98161 -0.11245 1 -0.079773 0.969 -0.83724 0.98161 -0.83721 1 -0.78345 0.8922 -0.74626

E4Prod 0.0019429 0.0018378 0.0016637 0.70601 -0.079773 1 0.0018378 -0.0020694 0.0016637 -0.0020625 -0.079773 -0.14606 -0.34886 -0.31266

S1 0.99899 1 0.99731 0.0023972 0.969 0.0018378 1 -0.9359 0.99731 -0.93589 0.969 -0.91024 0.77226 -0.8661

P1 -0.95003 -0.9359 -0.90876 -0.0019278 -0.83724 -0.0020694 -0.9359 1 -0.90876 1 -0.83724 0.9725 -0.57003 0.92613

S2 0.993 0.99731 1 0.0023819 0.98161 0.0016637 0.99731 -0.90876 1 -0.90874 0.98161 -0.88385 0.80368 -0.84089

P2 -0.95002 -0.93589 -0.90874 -0.0019207 -0.83721 -0.0020625 -0.93589 1 -0.90874 1 -0.83721 0.9725 -0.56999 0.92613

S3 0.95869 0.969 0.98161 -0.11245 1 -0.079773 0.969 -0.83724 0.98161 -0.83721 1 -0.78345 0.8922 -0.74626

P3 -0.92397 -0.91024 -0.88385 -0.20571 -0.78345 -0.14606 -0.91024 0.9725 -0.88385 0.9725 -0.78345 1 -0.4711 0.94984

S4 0.75093 0.77226 0.80368 -0.29709 0.8922 -0.34886 0.77226 -0.57003 0.80368 -0.56999 0.8922 -0.4711 1 -0.37586

P4 -0.87923 -0.8661 -0.84089 -0.18088 -0.74626 -0.31266 -0.8661 0.92613 -0.84089 0.92613 -0.74626 0.94984 -0.37586 1

Autocorrelation

T1 T2 T3 T4 T5

__________ __________ ___________ __________ __________

A1 0.20153 0.032782 0.00042194 -0.011956 -0.0074951

A2 0.20676 0.034361 0.00044046 -0.012175 -0.0076794

A3 0.21394 0.03655 0.00037985 -0.012522 -0.0079722

E3Prod -0.0040931 -0.0078807 -0.0050107 -0.0063428 -0.0047748

A4 0.16634 0.028203 -0.0014939 -0.012323 -0.0076489

E4Prod -0.0036683 -0.0073908 -0.0055611 -0.0073471 -0.0060193

S1 0.20676 0.034361 0.00044046 -0.012175 -0.0076794

P1 0.15238 0.018343 -0.00087912 -0.010131 -0.0064648

S2 0.21394 0.03655 0.00037985 -0.012522 -0.0079722

P2 0.15236 0.01833 -0.00088855 -0.010136 -0.0064651

S3 0.16634 0.028203 -0.0014939 -0.012323 -0.0076489

P3 0.23653 0.035239 0.0010105 -0.010435 -0.0081844

S4 0.00693 -0.0015752 -0.0066936 -0.010341 -0.0091342

P4 0.34143 0.046942 0.0011096 -0.0097003 -0.0088653